At current mortgage rates homes are NOT Affordable for American Home Buyers

In the past two years, the real estate market has boomed. There is a sizeable shift in American beliefs to convert from renting to owning a home. Further, migration to the suburbs during the pandemic spurred demand for homes, even driving the prices up. But come September 2022, the average home prices dropped from US $413,800 to $357,810, and yet real estate market did not boom. Though seemingly home prices fell, the frenzy to invest in a new home abated, with many potential home buyers abruptly calling off deals as they could no longer afford them. This decline can be partly attributed to the fall season, but the main reason behind the slowdown is the fresh spike in mortgage rates.

The housing sector throughout the US is reeling under burning inflation and high-interest rates. National Association of REALTORS® (NAR) has predicted existing-home sales to decline 15.2% in 2022 to 5.19 million units, while new home sales will fall by 20.9%. According to NAR Chief Economist Lawrence Yun, “The direction of mortgage rates – upward or downward – is the prime mover for home buying, and decade-high rates have deeply cut into contract signings. If mortgage rates moderate and the economy continues adding jobs, then home buying should also stabilize.”

Yes, Americas housing market has arrived at a critical juncture riddled with low affordability due to the sharp rise in mortgage rates.

The co-relation between inflation, interest rates, mortgage rates, and home prices

To control inflation, the Federal Reserve raised interest rates five times in 2022, with the most recent hike in September. This directly influenced mortgage rates reducing the home purchase sentiment index to its lowest level since October 2011. Most first-time home buyers are now waiting for inflation to come down to invest in property.

Historically higher interest rates and mortgage rates have proven to drive economic growth. An economy with a higher inflation rate can still support home prices and improve housing demand because higher wages and more employment assure homeowners lock a sizeable portion of earnings in home purchases. But as of now, the housing sector has slowed down in most cities across the country. Few believe that home prices will fall substantially and are waiting to enter the home buying market then. When will it be a buyers’ market and what’s next for the US housing market remains to be seen. While owning a home makes a safe investment, finding affordable shelter poses a challenge to most Americans.

Inflation, interest rates, and mortgage rates are now playing a role in directing the US real estate market.

High interest rates = less home for your money

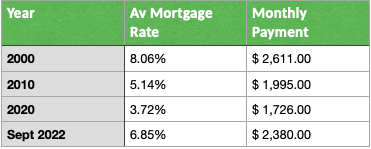

When interest rates are high, the homeowner will get less home for his money and vice versa. Here is an example of how the rising interest rates affect the home loan payment, making it difficult for a potential buyer to own a home in the US.

So, based on last year’s rates, if the person was looking to buy a home in the US by putting aside approx. $1700 per month for a new home the same today would cost $600 more.

The above housing interest rate chart shows that for a home costing $400,000 with a down payment of $80,000, the principal and interest payment in 2020-21 was $1,726 per month at an interest rate of 3.72%. Today, that same mortgage for 30 years at 6.85% would mean a monthly outgoing of $2,380. So, either the potential home buyer will have to compromise on the size/price of the home or then be ready to pay the extra monthly principal and interest payment.

No crisis comes without an opportunity

One may feel a bitter-sweet taste as moving to a new home may no longer be available and affordable. The average interest rate on a 30-year fixed mortgage has risen from 3.3% at the beginning of the year to 6.7% this September making a significant difference in the monthly payments for homeowners. But there are opportunities to evaluate before you go off home buying. Consider options like – Adjustable Rate Mortgage (ARM), 15-year mortgage term, rent-to-own contract, or first time homeowners grant from federal/state/local government. Whichever route you take, it is important to do due diligence on the best mortgage rates and how the purchase price is set. Also, look for mortgages with low or no fees.

Conclusion

Housing markets in California, especially around San Jose, Oakland, and Sacramento, are negatively impacted. Even Florida, Phoenix, and Austin have dampened buyer enthusiasm. While on one side, it may appear as an opportunity to buy a home, on the other hand, with higher mortgage rates, fewer people are competing and bidding for the same property shifting it into a buyers’ market. Home buying was and will always be a big decision – it is all about getting a PERFECT HOME, AT THE RIGHT TIME, AT THE BEST PRICE!